Older drivers are more likely to be involved in fatal crashes than their younger counterparts. That’s one reason seniors pay higher insurance premiums, even after a lifetime of driving.

The good news is, you can lower your rates by hundreds of dollars without sacrificing coverage. Here’s how to get the cheapest car insurance in Florida for seniors—and keep more money in your pocket.

How Much Do Florida Seniors Pay for Car Insurance?

According to Progressive, drivers in their 50s and 60s pay lower rates than at any other point in their lives. However, their annual premiums gradually increase after age 70-75.

| Car Insurance Rates by Age | ||

| Driver’s age | Average annual full coverage rate in Florida | National average annual premium |

|---|---|---|

| 18 | $7,212 | $3,608 |

| 20s | $6,825 | $2,762 |

| 30s | $3,245 | $2,405 |

| 40s | $3,778 | $2,270 |

| 50s | $3,581 | $2,008 |

| 60s | $3,098 | $1,714 |

| 70s | $3,722 | $1,745 |

| Sources: AutoInsurance.com, Experian. | ||

Factors That Affect Florida Seniors’ Car Insurance Rates

Age is just one of the many factors that affect your auto insurance premiums. Here are some other variables that impact what Florida’s seniors pay for car insurance:

Driving Record and Accident History

In Florida, just one speeding ticket can raise your car insurance premiums by around 16%, or $56 per month. If you’re found at fault in a crash, expect to pay 30-45% more for auto insurance.

A clean driving record could save you hundreds or even thousands of dollars per year. Plus, you may qualify for a safe driver discount, which can further lower your premiums. If you get a citation, see if you’re eligible to attend Florida traffic school. You may be able to get your ticket dismissed, which can help you maintain a clean driving record. (You’ll also get a 9% reduction on your citation!)

Location and ZIP Code

Insurance carriers use localized data—down to your ZIP code—to assess risk and calculate your premiums. So, while drivers in Alachua County may pay as little as $1,782 per year, drivers in Palm Beach County could shell out close to $5,100.

Vehicle Type and Safety Features

New cars often cost more to insure, but you may get lower premiums if you buy one with parking sensors, automatic braking, lane assist, or other safety features. The same goes for vehicles equipped with anti-theft systems, which may help you qualify for insurance discounts.

Consider the vehicle’s make and model, too, as these factors can push insurance costs up or down. Sedans and other smaller cars are typically cheaper to insure than SUVs because they cost less to repair in the event of a crash. If you own a luxury car—regardless of its size—you’ll likely pay higher rates.

Vehicle Usage

The less you drive, the lower your insurance will be—and the more likely you are to qualify for low-mileage discounts.

According to Insurance.com, driving 5,000 to 7,500 miles per year could lower your premiums by 7-22%, depending on your insurance provider and factors like age, location, and type of vehicle.

For instance, Floridians who drive under 7,500 miles annually can save around 9% on car insurance. If you plan to drive 7,500 to 9,999 miles per year, the discount drops to 6%.

Credit Score

Florida drivers with bad credit pay about 67% more for auto insurance than those with good credit scores. In other states, poor credit can raise insurance premiums by up to 239%!

Most states, including Florida, allow insurance companies to factor in your credit score for underwriting or rating purposes. They use this information to predict your likelihood of filing a claim and assess your risk profile.

State Regulations

Florida is a no-fault state, which means that after a car accident, each driver’s insurance provider covers up to 80% of their medical costs—no matter who caused the crash. While this allows accident victims to access medical care and compensation almost immediately, it also means insurance companies have to take on more risk, leading to higher premiums.

Plus, Florida law requires drivers to carry at least $10,000 in personal injury protection (PIP), which adds to the base premium and increases overall costs.

Gender and Marital Status

Insurance companies perceive married people as more stable and, therefore, charge them lower rates. Married couples may also benefit from having more than one policy or bundle various types of insurance to qualify for discounts.

Gender matters too. Female drivers in their 70s pay an average of $2,599 per year for full coverage, whereas male drivers of the same age pay around $2,642 (these rates vary by state and may be higher for senior drivers).

This is because statistically, men are more likely to engage in risky behaviors behind the wheel. California, Michigan, Hawaii, and a few other states prohibit insurers from using gender as a rating factor when determining how much to charge. However, Florida isn’t one of them.

Read: How to Find a Free Defensive Driving Course for Seniors

9 Ways to Get the Cheapest Car Insurance in Florida for Seniors (Plus One Bonus Tip)

From taking a Florida mature driver course to bundling policies, there are ways to get cheaper car insurance for seniors. The key is to shop around, compare multiple quotes, and apply for discounts.

Without further ado, take a look at the steps that can lower your insurance premiums by hundreds of dollars a year:

1. Shop Around

Auto insurance rates vary by hundreds of dollars from one company to the next, even for the same coverage. With that in mind, request multiple quotes from different providers and then compare them on a like-for-like basis.

For starters, check out State Farm, GEICO, Travelers, and UAIC. In August 2025, Florida seniors (70+) insured by State Farm paid around $2,027 per year for full coverage. The next lowest annual rate was offered by GEICO at approximately $2,103, according to a NerdWallet analysis.

Plus, companies like Allstate, GEICO, AAA, Mercury, and Amica all provide discounts to senior drivers who take a Florida mature driver course.

2. Compare Multiple Providers

Get quotes from at least three insurers. Visit their websites or use comparison tools like The Zebra, NerdWallet, Bankrate, or AutoInsurance.com to save time. Here’s what to consider when evaluating them:

- Compare apples to apples: Compare prices for policies with the same coverage level, deductibles, limits, and extras. Then, review your current policy to see how it stacks up against any new offers.

- Use a mix of sources: While some insurers offer lower rates when you request quotes directly from their websites, others may provide better deals through comparison platforms or online brokers. That’s why you’ll want to get quotes from multiple sources, even if it takes a little extra time.

- Check the company’s financial strength: Choose an insurance company that can afford to pay out if you ever file a claim. Check its financial health with two or three credit rating agencies, such as A.M. Best, Moody’s, Fitch, or Standard & Poor’s. An “A” rating or higher is ideal—anything lower could mean trouble in the long run. Here’s a list of possible ratings and what they mean.

- Read customer reviews: Once you have a list of insurance providers, look them up on Trustpilot, ConsumerAffairs, Yelp, and similar platforms. See what other customers say about their claim response time, coverage options, staff conduct, and discount offerings.

- Don’t get more than you need: The more coverage you get, the higher your premiums will be. To save money, cut extras like collision or comprehensive coverage—especially if you have an older car.

- Ask how your rates may change: Reach out to the insurers on your list and ask how often they adjust rates. For example, find out if premiums will go up when you turn 75, 80, or beyond. Or how much they might increase after a speeding ticket or at-fault accident.

3. Bundle Policies

Most insurance companies offer discounts for bundling two or more policies, such as home and auto insurance. Depending on the provider, you may also be able to combine car insurance with RV insurance, boat insurance, or life insurance.

This strategy can reduce your premiums by 5-20% or more and make it easier to manage your policies. For instance, consumers who insure both their homes and cars with State Farm save approximately $1,356 per year, depending on their location and other aspects we discussed earlier.

4. Take a Florida Mature Driver Course

One of the easiest ways to lower your premiums is to take safe driving classes for seniors. These courses vary in format and length, but can often be completed online within hours.

An example is the mature driver insurance discount course available to Florida residents aged 55 or older. It takes only six hours and can help you save up to 15% on car insurance for three consecutive years. It’s also an opportunity to refresh your knowledge of traffic laws and learn new techniques for staying safe on the road.

Florida law requires insurance carriers to offer discounts for customers who complete a mature driver course. Just make sure you choose a school licensed by Florida Highway Safety and Motor Vehicles (FLHSMV), or your certificate won’t be valid.

For more information, see our guide on how to take the mature driver course online in Florida.

5. Drive Less

Many seniors are retired or work part-time and only drive occasionally. If that’s the case for you, you may qualify for low-mileage discounts. Some insurers also offer pay-per-mile plans, which work great for retirees and individuals who work from home or close to home.

6. Choose a Safer Vehicle

Vehicles with high ratings in crash tests, as well as those with safety features like blind-spot detection, lane keep, or anti-lock braking systems (ABS), are typically cheaper to insure. They may cost more upfront, but they can save you thousands in insurance premiums over time.

According to recent evidence, some crash-avoidance features can reduce the risk of a collision by nearly 80%. These technologies are also associated with lower claim rates, which may result in insurance savings.

7. Maintain Good Credit

Pay your bills and accounts on time, keep a low balance, and apply for credit only when you need it. Also, review your credit report at least once a year to spot potential errors. You can get a free copy from Experian, Equifax, or TransUnion every 12 months.

As a general rule, don’t co-sign loans unless you’re 100% sure the primary borrower can pay on time. Even if they do, the full amount of the loan still counts against your total debt.

By taking these steps, you’ll find it easier to maintain good credit or improve your credit score, which in turn can lower your premiums.

8. Ask About Other Discounts

Ask your insurance company about any available discounts. These are generally based on your driving history, insurance policy, professional affiliations, and other factors.

Let’s see a few examples:

- Good driver discounts: 10-30%

- New vehicle discounts: 5-15%

- Multi-policy discounts: 10-25%

- Multi-vehicle discounts: 10-25%

- Defensive driver discounts: 5-10%

- Pay-in-full discounts: 5-10%

- Occupational discounts: 2-10%

- Usage-based discounts: 5-30%

- Loyalty discounts: 2-10%

9. Rinse and Repeat

Insurance companies update their rates annually, so set time aside for comparison shopping each year. Skip this step, and you could end up paying extra—even if nothing has changed on your end.

Make sure your new policy goes into effect on the same day your old one expires. A lapse in coverage can cost Florida drivers up to $591 more in auto insurance premiums.

Bonus tip: For further savings, consider paying a higher deductible. This is the amount you agree to pay out-of-pocket toward a claim before your insurance kicks in. The higher your deductible, the lower your monthly rates will be.

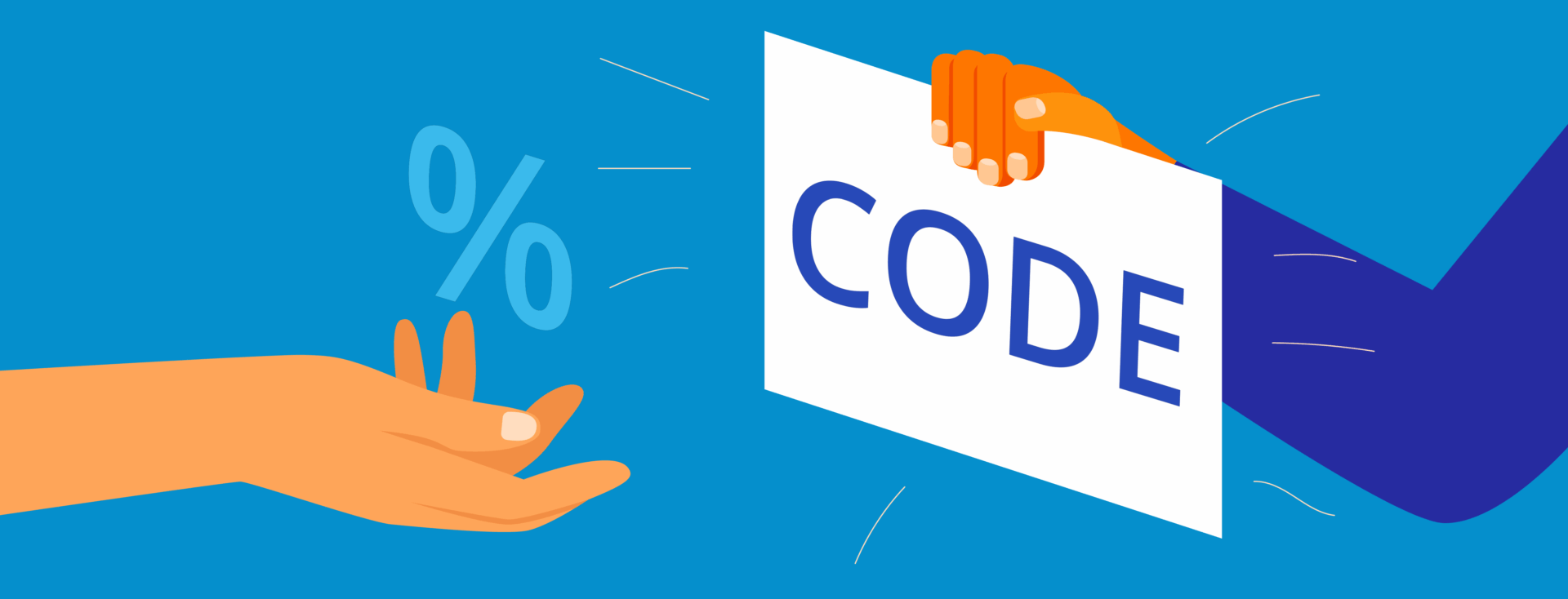

Save on Car Insurance with Traffic Safety Institute

Getting the cheapest car insurance in Florida doesn’t have to be difficult. You can lower your premiums within days just by completing a quick online course.

At Traffic Safety Institute, seniors aged 55+ can take a state-approved Florida mature driver course for as little as $25.99. Our classes are 100% online and self-paced, so you can study anytime from anywhere. Upon completion, submit your certificate to your insurance provider to get a discount of 5-15%.

Our students enjoy a world-class learning experience right from the start. They can sign up for free, access the course from any device, and contact our team 24/7. Other perks include:

✅ Free audio read-along

✅ Unlimited retakes

✅ Mobile-friendly content

✅ Save-and-resume feature

✅ Live chat support around the clock

✅ Instant electronic certificate of completion

✅ $100 minimum insurance savings guaranteed

✅ Don’t pay until you pass

The mature driver course at Traffic Safety Institute is accepted by all insurers in Florida. The best part? You don’t have to pay anything until you pass the final exam. Start our course for FREE today. Want to save even more? Use our Florida mature driver course promo code.

FAQs about the Cheapest Florida Car Insurance

Is there anything else you want to know about finding the cheapest car insurance for seniors? Below are the answers to some frequently asked questions.

Why is car insurance in Florida so expensive?

The Sunshine State has the third-highest cost for full coverage auto insurance in the U.S., with the average driver paying $3,874 annually. Possible reasons include the risk of natural disasters, as well as the large number of high-risk drivers. The state’s no-fault insurance system drives up the costs, too.

Florida also has more traffic fatalities and higher crash rates than other states. This aspect alone contributes to above-average premiums, explains Chase Gardner, Data Insights Manager at Insurify.

Do seniors get a discount on car insurance in Florida?

Seniors don’t automatically qualify for auto insurance discounts. Instead, they must ask about and apply for them—just like any other driver.

Per Florida law, you’re entitled to an insurance discount after completing a Florida mature driver course. This option is available to individuals aged 55 and above and can save you up to 15% annually for three consecutive years.

Does car insurance go up when you turn 70 in Florida?

Generally, yes. Once you reach age 70, most insurers will raise your premiums to account for age-related risks, such as slower reaction times and hearing loss. These cognitive and physical changes are normal but can impact your driving ability and increase the odds of a crash.