Californians pay an average of $3,102 per year for full coverage auto insurance—that’s around 50% more compared to 2020. The costs are even higher for consumers over 70 and those with a less-than-perfect driving record.

If you’re thinking about cutting coverage to save money, don’t do it just yet. We’ve compiled a list of California car insurance discounts that could lower your premiums by hundreds of dollars.

12 California Car Insurance Discounts to Help Lower Your Rates

Most insurers offer many different discounts on car insurance. Potential savings and eligibility criteria vary by insurer. Here are 12 car insurance discounts available to California drivers.

Good Driver Discount

Potential savings: 20%

Who the discount is for: Californians who maintain a clean driving record.

How to qualify: California law requires insurance carriers to offer 20% off to drivers who meet the following requirements:

- Held a valid driver’s license for at least three years.

- Received no more than one demerit point in the past 36 months.

- Has no felonies or misdemeanors on their driving records.

- Has no at-fault accidents resulting in bodily injury or death in the last three years.

Got a ticket for a one-point violation? You can attend traffic school to mask it from your record. Upon course completion, the point will be hidden from insurance providers, so you may still qualify for the good driver discount.

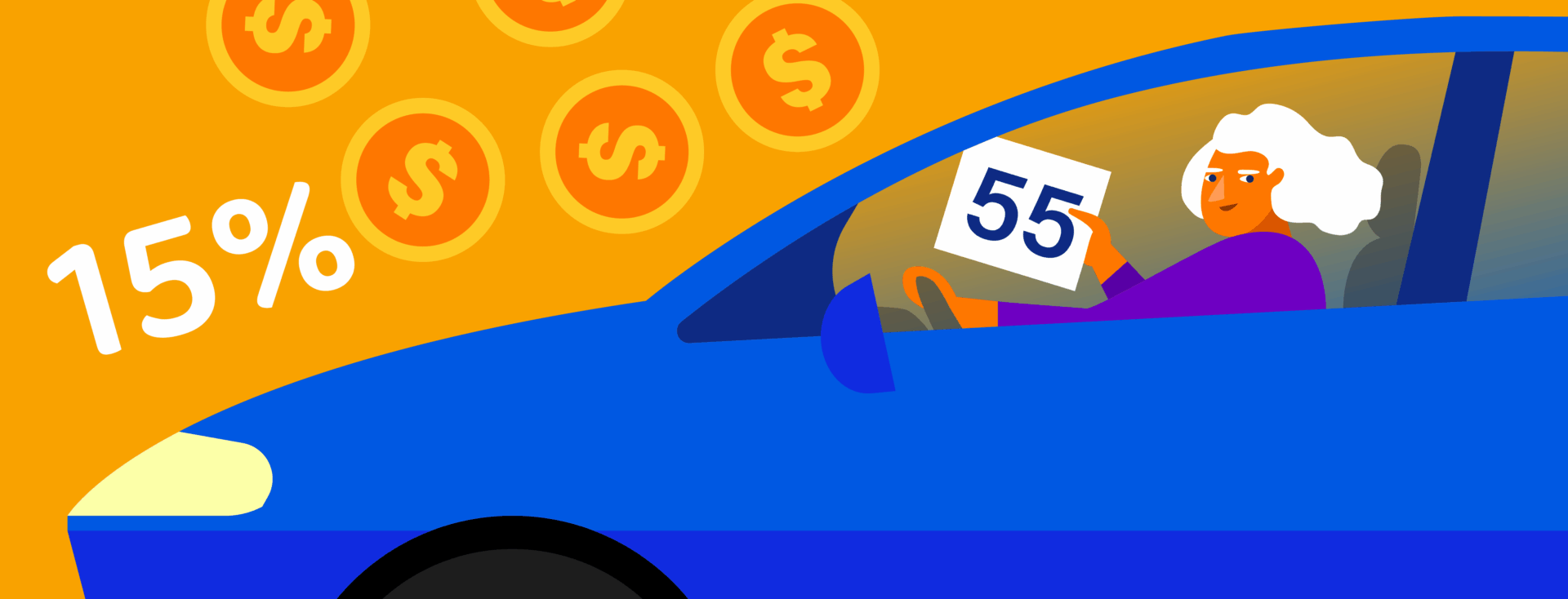

Mature Driver Discount

Potential savings: 5-15% per year for three consecutive years

Who the discount is for: Californians aged 55+ who complete a state-approved California mature driver course.

How to qualify: The mature driver discount is available to Californians who complete an online or in-person course designed for senior drivers. The course must be approved by the state’s Department of Motor Vehicles (DMV), or your certificate won’t be valid.

Once the course is over, submit your certificate to your insurance provider for savings of up to 15%. The discount applies for three consecutive years, as long as you’re not convicted of a DUI or found at fault in a crash.

💡 Our mature driver program is accredited by the California DMV and accepted by all insurers. You can complete it online at your own pace in just six and a half hours—or as little as four hours if you’ve taken it within the past three years.

Read: Cheapest Car Insurance for Seniors in California

Good Student Discount

Potential savings: 5-25%

Who the discount is for: Full-time students aged 16 to 25 who maintain a minimum B average.

How to qualify: Most insurance companies will lower your premium if you’re a student and show a report card or transcript with a “B” average or higher. Some may also require the following:

- Be in the top 20% of your class.

- Be listed on the Dean’s List or Honor Roll.

- Maintain a GPA of 3.0 or higher (on a 4.0 scale).

For instance, Nationwide offers a 10% discount for students who meet these requirements. Homeschooled students may also qualify if they score in the top 20% on a standardized test or maintain a B average on a report card issued by a certified teacher or public school.

EBT Insurance Discount

Potential savings: Varies by insurer.

Who the discount is for: Low-income drivers with a valid EBT card.

How to qualify: Some auto insurers offer reduced rates for Californians on low-income assistance programs. California Low Cost Auto (CLCA), a state-sponsored program, enables drivers to purchase cheap liability coverage for themselves and eligible secondary drivers.

Qualification criteria include:

- Be at least 16 years old

- Own a car worth $25,000 or less

- Have a clean driving record

- Meet specific income eligibility requirements

Be aware that California’s minimum liability limits increased in January 2025, and the CLCA’s current coverage limits are now lower than what the law requires. Therefore, eligible drivers must purchase additional coverage or a supplemental policy to stay compliant.

Multi-Vehicle Discount

Potential savings: 8-25%

Who the discount is for: Drivers who own more than one vehicle.

How to qualify: You can save up to 25% on car insurance if your household insures two or more vehicles with the same carrier.

Another requirement is to keep the vehicles primarily at your address. For example, if your child goes to school out of state, you’ll only get the discount if your home is listed as their primary address and the car is usually kept there.

Mileage-Based Discount

Potential savings: Up to 30%

Who the discount is for: Californians who don’t drive much.

How to qualify: State Farm, AAA, Nationwide, and other major insurers may lower your premiums if you drive less than 7,500 to 8,000 miles annually.

When you enroll in a mileage-based program, you’ll submit your estimated annual mileage to your insurance provider. After that, they’ll monitor your driving through a telematics device, mobile app, or odometer checks.

This is actually one of the best ways to get cheap car insurance for seniors, who are often retired and don’t drive much. Be sure to ask your insurer about the low-mileage discount, as they might not bring it up unless you do.

Student-Away Discount

Potential savings: 5-30%

Who the discount is for: Families with a student who goes to school more than 100 miles from home.

How to qualify: You could save up to 30% on car insurance if your child is between 16 and 25, moves away to school, and only drives your car occasionally (e.g., on holidays) while at home.

This discount is based on reduced risk. Teen drivers are statistically more likely to get involved in car crashes, so the less they drive, the lower the risk of filing a claim.

Career-Based Discounts

Potential savings: 5-20%

Who the discount is for: Military members and certain professionals, such as teachers, physicians, or scientists.

How to qualify: Certain professions are associated with safer driving habits and a lower risk of filing insurance claims.

For example, full-time K-12 teachers who purchase coverage from Mid-Century Insurance Co. can save up to 18%. The same applies to dentists, physicians, and veterinarians. If you’re a lawyer or architect, expect a discount of around 12%.

Firefighters, pilots, engineers, police officers, librarians, and other professionals may qualify for occupational discounts, too. Eligibility requirements vary among insurers, but generally, you must submit proof of employment or a copy of your professional license.

Multi-Policy Discount

Potential savings: 8-25%

Who the discount is for: Consumers who bundle car insurance with other policies.

How to qualify: Purchase auto insurance along with other policies—like home, boat, life, or health insurance—from the same company to lower your premiums.

For instance, Liberty Mutual customers who bundle auto and home insurance can save more than $950 per year. The more insurance products you have with one carrier, the higher the savings.

Usage-Based Discounts

Potential savings: 5-10% for enrolling, plus 5-40% based on your driving behavior.

Who the discount is for: Consumers willing to have their driving habits monitored.

How to qualify: Usage-based discounts reward good driving behavior. To qualify, you must agree to have your driving habits monitored via a mobile app or plug-in device. Your insurance carrier will use this data to adjust your premiums.

Under California’s Proposition 103, insurers may only track annual mileage and cannot use data like speed, location, or braking habits to set their rates. However, this restriction doesn’t apply in other states.

Loyalty Discounts

Potential savings: 5-10%

Who the discount is for: Policyholders who stay with the same insurance provider for several years.

How to qualify: Stick with the same insurance carrier for at least one year, and you could save up to 10% on your policy. Note that some insurers may take into account how many years you stayed with your previous provider.

Vehicle Safety Discounts

Potential savings: Up to 40%

Who the discount is for: Drivers who own vehicles with modern safety features like anti-lock brake systems (ABS), anti-theft devices, automatic seatbelts, and airbags.

How to qualify: Vehicles with advanced safety features are less likely to be stolen or get involved in a collision. As a result, they may qualify for lower insurance premiums.

To apply for this discount, you’ll need to provide your vehicle identification number (VIN), registration certificate, or other supporting documents.

Other Car Insurance Discounts

Each insurance company has its own set of discounts. For example, some insurers may offer lower rates for customers who belong to professional associations, pay in full or online, or park their car in a garage. Others incentivize policyholders who take defensive driving classes for seniors.

If your policy is about to expire, look for an insurance carrier that offers discounts tailored to your needs. While most insurers reward loyalty, shopping around could unlock bigger savings.

How Much Can You Save?

California car insurance discounts are often stackable, meaning you could qualify for several at once and reduce your premium by 50% or more. Insurers usually cap total savings at a set percentage, but you can still save hundreds—or even thousands—per year.

The discounts apply one at a time. For example, if your annual premium is $3,000 and you qualify for a 10% mature driver discount, you save $300. Then, if you bundle policies and get 15% off, that 15% applies to the new rate ($2,700). If you qualify for multiple discounts at once, they apply one after the other.

Additional Tips for Saving on Your California Car Insurance

With car insurance rates rising year after year, you’ll want to look into every possible way to save money. Discounts can be helpful, but there are several other strategies to cut costs and still get the protection you need. Here are a few to try.

Shop Around

According to a Consumer Reports survey, policyholders who switched car insurance providers between 2020 and 2024 saved an average of $461 per year. About 41% reported savings of at least $500, and 13% said they saved $1,000 or more.

Use comparison websites like The Zebra, Insurify, or NerdWallet to research your options. Request quotes from at least three insurance companies, then compare them side by side.

Raise Your Deductible

A deductible is what you pay out of pocket in the event of a claim before your policy kicks in. The higher this amount, the lower your insurance rates will be.

According to Consumer Reports, raising the deductible from $500 to $1,000 can result in savings of 20-25%. For a more accurate estimate, compare quotes from multiple insurers— but with different deductible amounts.

Drive Less

Low-mileage discounts can reduce your premium by up to 30%, resulting in annual savings of hundreds of dollars.

Per AutoInsurance.com, seniors who drive fewer than 5,000 miles per year pay about $1,819 for full coverage. By comparison, drivers with standard mileage spend around $2,400 annually. The savings can be even greater in California, where mileage is one of the main factors insurers take into account when setting their rates.

If you’re retired or working remotely and barely use your car, let your insurer know. Ask whether they offer a low-mileage program or discounts for driving less.

Choose Your Car Carefully

Luxury vehicles, sports cars, and high-end electric models often come with higher premiums. The reason is that they’re prime targets for theft or cost more to repair in the event of a crash.

At the opposite end are smaller cars, minivans, and vehicles with strong crash-test ratings or advanced safety features. Older cars can be more or less expensive to insure, depending on their overall condition and safety technologies.

For example, consumers who drive a Honda CR-V or Subaru Forester pay less than $2,200 per year for auto insurance. But if you own a high-performance sports car like the Audi R8, your annual premiums will likely exceed $6,500.

Pay Annually

Consider paying for your policy in full to save 6-14% or more. Monthly or quarterly payments might feel more convenient, but they usually come with administrative and service fees that drive up the cost.

If paying the full amount upfront isn’t feasible, then sign up for autopay. Many insurers offer a small discount for customers who choose this option.

Bundle Home and Auto Insurance

You’re already paying for home and auto insurance, bundling them could mean 10% or more in savings on each policy.

Bundling doesn’t just save you money, it also makes it easier to manage your policies. You’ll only have one bill to pay and one insurance provider to deal with.

Go Paperless

Some insurers offer up to 6% off just for paying your premiums online. By switching to electronic billing, you help reduce their administrative costs—and they may pass those savings on to you.

Review Your Coverage Annually

Insurance companies update their rates annually based on market conditions and other factors. Your insurance needs may also change over time, especially if you buy a new car, add safety features, move to another city, or reduce your mileage.

Take the time to review your coverage each year. For example, if you move to a safer neighborhood, you might be able to secure better rates or remove add-ons you no longer need.

Ask About Discounts

Not every discount is listed on the insurer’s website or mentioned upfront. That’s why you should ask about any potential savings and what it takes to qualify.

For instance, some insurers offer discounts for parking your car in a garage, but they may not mention it unless you ask. If they don’t know where you keep your vehicle, they have no reason to bring it up.

Why Take a Mature Driver Course with Traffic Safety Institute

While some discounts aren’t widely advertised, others are mandated by law and available to all eligible policyholders. One example is the mature driver discount, which can lower your premiums by 5-15% for three consecutive years.

To qualify, you must complete a state-approved California mature driver course like the one at Traffic Safety Institute. Our program is 100% online and self-paced, giving you the freedom to study from any device, including smartphones.

The curriculum covers traffic law updates, as well as other relevant topics, such as new vehicle safety technologies, defensive driving, and collision prevention. You’ll also learn about the impact of aging on driving performance and how to cope with these changes.

Our mature driver course consists of 13 easy-to-follow modules and a final exam, plus all sorts of perks for a stress-free learning experience. Here’s what you’ll get:

✅ Unlimited retakes

✅ Practice quizzes after each lesson

✅ Free audio read-along

✅ Interactive learning materials

✅ Automated progress tracking

✅ Instant electronic certificate

✅ Physical certificate shipped for free

✅ Live chat support around the clock

✅ $100 Savings guarantee

Car insurance is expensive, so why leave money on the table? If you’re over 55, our mature driver program can help lower your premiums by hundreds of dollars. Start the course for FREE today.

FAQs About California Car Insurance Discounts

Is there anything else you want to know about car insurance discounts in California? Below are the answers to some frequently asked questions:

Why are CA insurance rates so high?

Californians pay more for car insurance than drivers in other states due to traffic conditions, regulatory changes, and environmental factors. For instance, the frequency of wildfires increases the risk of property damage claims, prompting insurance carriers to charge higher premiums.

Another reason is that California prohibited insurers from raising their rates during the COVID-19 pandemic. While this initiative helped consumers in the short term, it later contributed to a sharp spike in insurance costs.

Does credit score affect CA insurance?

No, it doesn’t. California law prohibits insurers from using credit-based scores to set or adjust their premiums.

What is the new law for car insurance in California?

Starting January 1, 2025, California increased the minimum liability coverage limits for the first time in more than 50 years. The current requirements are:

• $30,000 for bodily injury or death to one person

• $60,000 for bodily injury or death to more than one person

• $15,000 for property damage

These new limits apply when you renew your policy and may result in higher insurance costs.