Teenagers and young adults pay a small fortune for auto insurance.

So, at what age does car insurance get cheaper? The answer is typically around 25. But age alone doesn’t guarantee lower premiums—your driving history, coverage level, and even ZIP code all play a role.

In this guide, we’ll discuss how age influences car insurance rates and the steps you can take to cut costs. Let’s dive in.

At What Age Does Car Insurance Go Down?

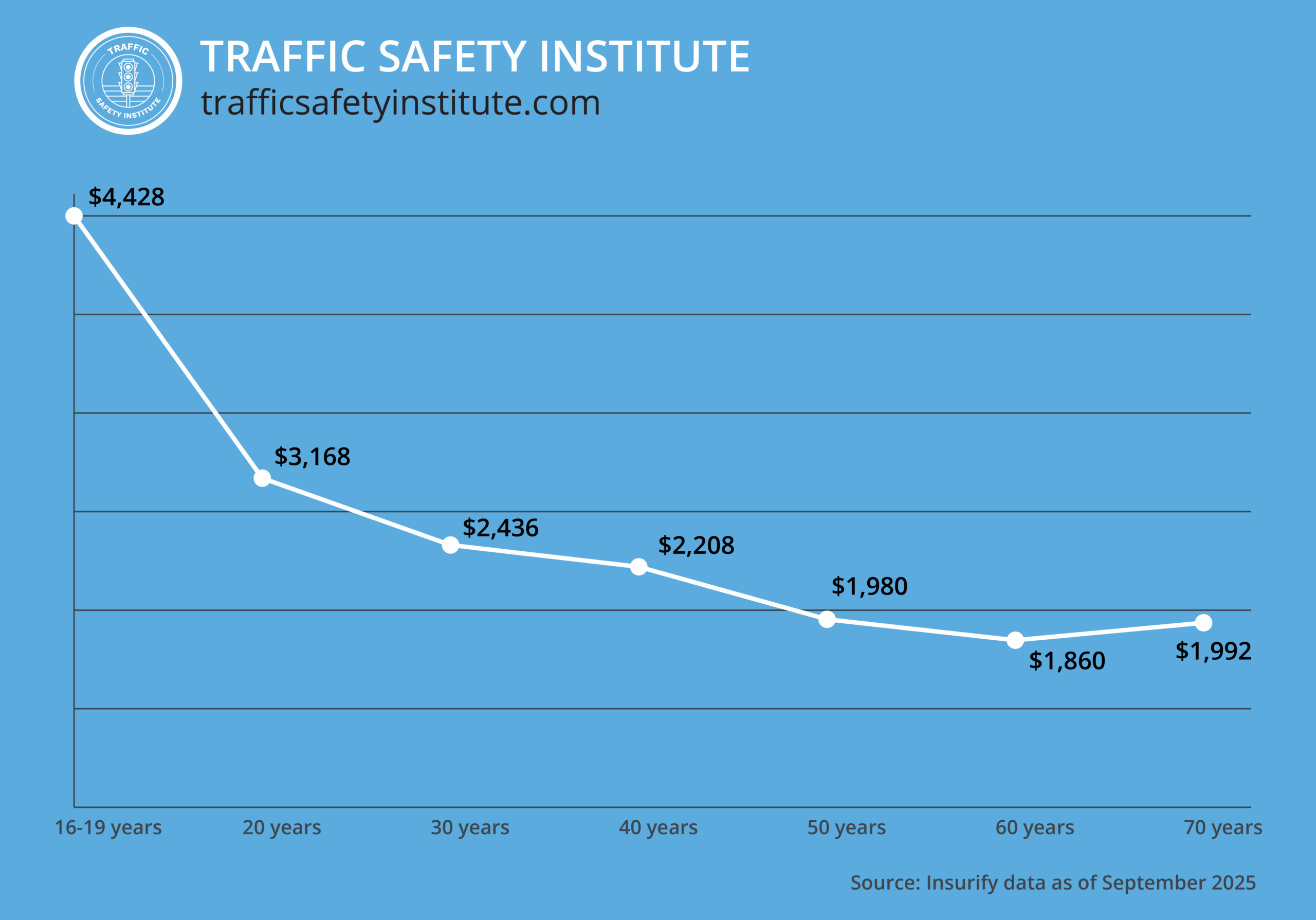

According to the Insurance Institute for Highway Safety (IIHS), teen drivers are four times more likely to be involved in an accident per mile driven than those aged 20 and older. That’s why they face the highest premiums, averaging about $4,428 annually.

Car insurance rates typically begin to drop between the ages of 20 and 25 but generally remain high until around age 30. They decrease gradually through midlife, hit their lowest point near age 60, then rise again after 70-75.

The graph below shows how age influences auto insurance premiums:

Source: Insurify data as of September 2025

As young drivers gain experience, their risk to insurers decreases, often leading to lower premiums. This explains why a 30-year-old pays about 23% less for full coverage than a 20-year-old and 45% less than a teen driver.

Car insurance premiums tend to rise again later in life due to age-related changes that affect driving ability and increase crash risk. Drivers aged 70 and older have higher fatality rates per 1,000 crashes than those between 35 and 54, resulting in greater liability for insurers.

That said, a 30- or 40-year-old with multiple at-fault accidents or violations may pay more for coverage than a 70-year-old with a clean record. For example, a 35-year-old California driver will shell out an extra $947 per year for car insurance after a single speeding ticket.

Key Milestones Where Insurance Premiums Drop

Insurance premiums fluctuate throughout your lifetime, with the most noticeable drops happening at key milestones, including:

- Age 18-19: Turning 19 brings a significant drop – about 19% lower than age 18, according to Bankrate data.

- Age 20-21: Drivers turning 21 often see their premiums decrease by about 17%.

- Age 24-25: Insurance costs decrease by more than 12% between ages 24 and 25, assuming you maintain a clean driving record.

- Ages 25-30: Expect a 15% decline in premiums between ages 25 and 30, as you gain experience behind the wheel.

Car insurance rates drop most between ages 18 and 19. Still, these figures are only estimates, and what you’ll actually pay depends on various factors, such as your gender, location, and driving history.

Factors That Affect Car Insurance Rates

In California, auto insurers can use three primary rating factors to determine your insurance rate: your driving history, annual mileage, and how long you’ve been licensed. Additional considerations are allowed only if they’re proven to affect risk.

Many other states allow insurers to factor in personal details like age and gender when calculating premiums. Although the factors used to determine your rates differ by state, Let’s take a brief look at some of the key factors that are considered.

Your Driving Record and Behavior

A history of traffic offenses can skyrocket your premiums, regardless of your age or driving experience.

- Accidents and claims: Every accident and claim is a red flag for insurers. Just one at-fault accident can increase your premiums by up to 50% or more for three to five years.

- Violations: Speeding 15 mph over the limit may raise your premiums by nearly 40%. A first-time DUI can double your rate, while a second offense may push it up by more than 200%. Even minor violations matter—texting while driving typically results in a 32% increase, and running a stop sign can lead to a 36% hike.

- Mileage: The more miles you drive each year, the greater your risk of being involved in an accident. California places special emphasis on mileage, and drivers who log 25,000–30,000 miles annually may pay 20–30% more for auto insurance than those driving less than 10,000 miles. In most other states, mileage has a smaller impact, typically raising rates by 5–10%.

- Type of use: How you use your car matters, too. Insurance companies factor in your vehicle’s primary purpose, whether it’s for commuting or pleasure, when calculating your premiums. Regular commuting often means more time spent on the road, which may increase crash risk and lead to higher premiums.

- Telematics: Some insurers offer usage-based programs that use telematics technology to monitor driving behavior. In this case, a device or mobile app collects data on speed, mileage, braking, and other factors as you drive. Insurance companies use this real-time feedback to adjust their premiums, often rewarding safe drivers. The average savings are around 10%.

Your Vehicle

What you pay for auto insurance also depends on your car’s make, model, safety features, and other characteristics. Here’s why.

- Make and model: Car models can vary significantly in quality and safety, factors that influence insurance premiums. Generally, luxury cars and sports vehicles are the most expensive to insure. Manufacturers that are known for producing reliable vehicles with strong safety ratings and solid crash-test performance tend to cost less to insure.

For example, the Chevrolet Malibu shows worse-than-average insurance losses across multiple categories. For this reason, it costs more to insure compared to a Honda Accord, Volkswagen Jetta, or Toyota Camry 4WD, which perform significantly better. - Model year: Newer vehicles cost more to repair or replace than older cars, resulting in higher insurance premiums. However, owning an older car doesn’t always mean lower insurance costs, especially if it’s a classic or rare model.

- Safety features: Vehicles with advanced safety features — like automatic emergency braking, blind-spot detection, or lane-centering — often qualify for lower insurance rates. These technologies reduce crash risk and claims, so if you’re shopping for a new car, consider models on the IIHS Top Safety Picks.

- Anti-theft devices: Cars with higher theft risk cost more to insure, but adding anti-theft features like tracking systems, alarms, or steering wheel locks can lower that risk. Many insurers offer discounts of 5-25% for factory-installed anti-theft systems or approved aftermarket devices.

- Your car’s value: Luxury cars, classic vehicles, and sports models come with higher repair and replacement costs, often translating into steeper insurance premiums. The same goes for electric vehicles, which are more expensive to repair than the average car.

Location

Drivers living in areas with high accident or crime rates usually pay higher insurance premiums. Insurers also consider claim frequency and other location-specific risks, such as natural disasters.

- Zip code: Insurance companies use ZIP codes to assess risk and set their premiums. For example, drivers in Newton, Illinois (ZIP code 62448), pay just $95 per month for full coverage, while those in Las Vegas, Nevada (ZIP code 89110), face premiums as high as $366 per month. That’s a nearly fourfold difference driven by risk factors like accident rates, crime levels, and weather-related claims.

- Urban vs. rural areas: Living in urban areas usually means higher premiums due to heavier traffic, more theft and vandalism, and higher repair and medical costs compared to rural regions.

- Garage vs. street parking: Insurers may charge higher premiums for vehicles without secure overnight parking. A car parked in the street is more likely to be stolen or damaged than one kept in a garage.

Policy Choices

Your premiums also depend on how much coverage you need and the deductible you choose. (A deductible is the amount of money you’ll pay in the event of a claim before your policy kicks in.)

Now let’s see how these factors influence insurance costs:

- Coverage limits: The more coverage you purchase, the higher your insurance premiums. For example, California drivers who opt for minimum coverage pay an average of $912 per year. If you want full coverage, you’ll pay around $3,108.

- Deductible amount: A higher deductible translates into lower insurance costs. Drivers who raise their deductible from $500 to $1,000 can save 20-25% annually.

Insurance Discounts

Most insurers offer discounts that can lower your premiums by hundreds or even thousands of dollars. The discounts are stackable up to a limit set by each provider, so you can combine them for maximum savings.

Here are a few examples:

- Mature driver discount: Californians aged 55 and older can save 5-15% on car insurance by completing a mature driver course approved by the state’s Department of Motor Vehicles (DMV). The mature driver discount applies for three years as long as you avoid DUIs and at-fault accidents.

- Multi-policy discount: Bundling two or more insurance policies can result in savings of up to 25%. You can also save money by insuring more than one vehicle with the same carrier.

- Paid-in-full discount: Consider paying your premium in full to save 5-20% on car insurance. Some insurers also provide discounts for paying online.

- Good driver discount: Californians with a clean driving record may qualify for a 20% discount on auto insurance called the good driver discount. One of the main requirements is to have no more than one point on your license within the last 36 months.

Most insurance carriers also offer discounts for installing anti-theft systems, parking your car in a garage, or switching to digital billing. Military members and certain professionals, such as CPAs, teachers, and healthcare providers, may get lower premiums, too.

Be sure to ask about available discounts, as many are not prominently advertised. Also, keep in mind that some perks, like the mature driver discount, are mandated by state law for eligible drivers.

Other Factors

Insurers may use a couple more factors to determine insurance rates. These include:

- Gender: Male drivers are statistically more likely to engage in risky behaviors than their female counterparts, so they typically pay higher auto insurance premiums. Only California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, and Pennsylvania prohibit auto insurers from using gender as a rating factor.

- Marital status: Married individuals pay approximately $2,122 per year for full-coverage auto insurance. By comparison, single people pay around $2,413 because they’re considered higher-risk drivers. Divorcees may see their premiums rise by as much as 22%, depending on the insurance carrier and state regulations. Only a few states – Hawaii, Massachusetts, Michigan, and Montana – limit or ban marital status as a rating factor.

- Credit score: In most states, drivers with poor credit scores tend to pay significantly more for auto insurance. Insurers view credit-based insurance scores as indicators of how likely a driver is to file a claim. However, some states — including California, Hawaii, Massachusetts, and Michigan — ban or restrict the use of credit scores in determining auto insurance premiums.

How to Get Cheaper Car Insurance

You can have a spotless driving record and still end up overpaying for car insurance due to factors like age or location, which are beyond your control. Luckily, there are ways to cut costs without sacrificing coverage. Here are some things to try.

Shop Around

Insurance costs vary by hundreds of dollars from one company to the next. With that in mind, request quotes from at least three providers or use platforms like NerdWallet, Insurify, or The Zebra to compare rates side-by-side.

As a rule of thumb, compare offers for the same deductible amount and coverage limits. Always check the fine print to understand what your policy actually covers and what’s excluded. It’s also a good idea to ask how your premiums will change after a claim or traffic violation.

Seek Out Discounts

Take the steps needed to qualify for any discounts that make sense to you. If, say, your insurer is willing to give you 10% off for bundling policies, then go for it.

Planning to buy a new car? Ask your insurance provider which makes and models could help you unlock the biggest savings.

Some insurers may also lower your rates if you take a defensive driving course, upgrade your car’s safety features, or set up automatic payments. These steps take little effort on your end and could save you thousands annually.

Improve Your Driving Record

Depending on where you live, you can dismiss or mask a ticket by completing traffic school. This way, the conviction won’t affect your insurance premiums or driving record.

- For example, taking traffic school in California will mask one point from your license. If you study online, you can finish in as little as two or three hours. It’s a small effort that pays off big.

- Similarly, Nevada drivers can attend traffic school to remove three points from their records. The course lasts only five hours and can be completed online.

- Texas residents can take a driver safety course (which is the equivalent of traffic school) to dismiss a traffic ticket. The course duration is approximately six hours, regardless of whether you study online or in person.

It’s also smart to check your driving record for inaccuracies at least once a year. Small errors can sneak in and inflate your premiums or prevent you from qualifying for insurance discounts.

Take a Mature Driver or Defensive Driving Course

Insurance companies in California and a few other states are legally required to offer discounts for policyholders who are 55 or older and who complete a DMV-approved mature driver course.

At Traffic Safety Institute, we provide mature driver courses in Florida and California. Our programs are accredited by the Florida Highway Safety and Motor Vehicles (FLHSMV) and the California DMV and accepted by all insurers in each state.

Either course can save you 5-15% on auto insurance. The discount is valid for three consecutive years and can reduce your premiums by hundreds if not thousands of dollars.

FAQs About Car Insurance Rates by Age

Is there anything else you want to know about the relationship between your age and insurance premiums? Here are the answers to some of the most common questions we get from students:

Does insurance go down at 21?

Turning 21 could lower your premiums by around 17% compared to when you were 20, but you’ll still pay more than a 25- or 30-year-old.

Does insurance go down at 25?

Generally, yes. A 30-year-old driver pays about 23% less for full coverage than a 20-year-old. What you’ll pay depends on your driving history, among other factors. A less-than-perfect driving record can keep your premiums high at any age.

Does insurance go up at age 70?

Insurance costs typically increase after age 70. According to Bankrate, a 70-year-old driver must shell out around $2,635 for full coverage, whereas a 60-year-old pays only $2,430. However, you may be able to save 5-15% with the mature driver discount.

At what age is the most expensive car insurance?

Drivers aged 16 to 19 pay the highest insurance rates due to their limited experience behind the wheel. If you belong to this age group, consider applying for the good student discount to save 5-25% on your policy.

At what age is the cheapest car insurance?

If you have a clean driving record, your premiums should reach their lowest level at around age 60.