Car insurance premiums often rise after age 70, even for drivers with a clean record. One reason is that older adults have a greater risk of fatal crashes than younger people, so insurers offset that risk by charging more.

The solution? Shop smarter and apply for any discounts you may be entitled to. Take these steps to find the cheapest car insurance for seniors in California without sacrificing coverage.

How Much Do California Seniors Pay for Car Insurance?

According to CarInsurance.com, California drivers in their early 60s pay an average of $2,257 per year for full coverage. By the time they turn 65, their annual premiums increase to $2,284 and continue to rise with age.

| Car Insurance Rates by Age | ||

| Driver’s age | Average annual full coverage rate in California | National average annual premium |

|---|---|---|

| 18 | $6,252 | $6,192 |

| 20 | $4,381 | $4,316 |

| 30 | $2,556 | $2,275 |

| 40 | $2,416 | $2,105 |

| 50 | $2,345 | $1,957 |

| 60 | $2,257 | $1,871 |

| 70 | $2,416 | $2,074 |

| 75 | $2,571 | $1,745* |

| Sources: CarInsurance.com, Forbes, *Experian. | ||

Factors That Affect Car Insurance Rates for California Seniors

Car insurance costs depend on several factors, from age and gender to state regulations.

Let’s look at the top factors affecting premiums in California.

Age

Middle-aged drivers pay the lowest car insurance rates, but even with a clean driving record, their premiums start rising around age 70-75. This increase is due to a mix of risk factors, including:

- Crash rates are higher among drivers aged 70+.

- Collisions involving older drivers are more likely to cause serious injury or death.

- Age-related impairments can affect driving ability and raise crash risk.

Read more in: How Does Age Affect Driving?

Driving Record

In California, insurance rates rise by around 45% for three years or longer after a single speeding ticket. The more severe the offense or the more violations you have on your record, the higher your premiums.

A clean driving record not only keeps your insurance costs down, but it may also help you qualify for further savings. Californians with more than one demerit point in the past 36 months are legally entitled to a 20% California good driver discount.

Mileage and Usage

Under California law, annual mileage is the second most important factor affecting auto insurance premiums, coming right after your driving safety record.

Californians who drive less than 7,500 miles per year can save about 17% on auto insurance. Those logging 10,000 to 11,999 miles annually see a smaller discount—around 10%.

From an insurer’s perspective, the more time you spend on the road, the higher the likelihood of having an accident. For this reason, car insurance rates are determined based on how much you drive, among other variables.

Vehicle Type and Safety Features

Vehicles equipped with adaptive cruise control, automatic emergency braking, blind spot monitoring, or other safety features often cost less to insure. These technologies may reduce crash risk, which can lead to lower premiums.

Your car’s make and model come into play, too. For instance, vehicles with strong safety records or lower theft rates often qualify for cheaper insurance. Expect higher premiums if you drive a luxury or sports car, as these vehicles typically cost more to repair after a crash.

Location

Insurance companies use your ZIP code to assess risk and determine pricing. That means even your neighborhood can affect how much you pay. Californians living in areas with high crime, heavy traffic, or frequent natural disasters typically pay more for car insurance.

For example, the average annual premium is $2,791 in Los Angeles and $2,339 in San Francisco, as these cities have high traffic density, accident rates, and theft risk. Drivers in San Diego and San Jose pay considerably less: about $1,900 per year for the same coverage.

Senior Discounts

Depending on the state and insurance provider, drivers aged 50 and above may be eligible for senior-specific discounts.

For instance, California law requires insurers to offer a 5-15% discount for customers who complete a state-approved California mature driver course. To qualify, you must be at least 55 and have no DUIs or recent at-fault accidents on your record.

Credit Score

Along with Michigan, Hawaii, and Massachusetts, California is one of the few states that prohibit insurers from using your credit score to calculate premiums.

In other states, drivers with bad credit pay extra for car insurance because poor financial management signals a higher likelihood of filing claims.

Economic and Environmental Trends

In California, certain areas are prone to natural disasters and extreme weather, which insurers rate as higher risk, leading to steeper premiums. In 2025, the California Department of Insurance said forward-looking wildfire catastrophe models were one of the key drivers of rate increases in California.

Auto insurance premiums are also determined based on economic factors like inflation or supply chain issues. For example, inflation drives up the cost of vehicle repairs and medical bills, resulting in higher insurance costs.

State Regulations

In California, insurance companies must obtain state approval before raising their rates. This law protects consumers from excessive premium increases and promotes a competitive market.

Read: California Car Insurance Discounts

8 Ways Seniors Can Get the Cheapest Car Insurance in California

Finding the cheapest car insurance for seniors in California isn’t easy, given all the factors that go into determining your premium. However, there are steps you can take to lower your rates—even with a less-than-perfect driving record.

Not sure where to start? Try these strategies to maximize your savings:

1. Shop Around

Request at least three quotes from different insurance companies, then compare them side-by-side. Since each insurer calculates rates differently, it’s worth shopping around rather than settling for the first offer you get.

According to NerdWallet research, GEICO and Mercury have the cheapest full-coverage auto insurance for seniors in California.

2. Compare Insurance Providers

Use an insurance comparison site like The Zebra, Bankrate, or Insurify to generate and compare quotes from multiple providers. Fill out an online form, then follow these best practices when selecting a policy:

- Compare apples to apples: Compare prices for policies with the same deductible, limits, and amount of coverage—and evaluate them against your current policy. For example, a $2,200 policy with minimal liability coverage isn’t the same as a $2,500 policy that includes full coverage. While the latter costs more, it offers greater value for the money.

- Use a mix of sources: Some insurers offer lower rates if you buy directly from them, while others may come out cheaper through a broker or comparison tool. Always check multiple sources, even if it takes a bit longer.

- Check the company’s financial strength: Your policy holds little value if the insurance provider cannot pay out claims. To stay on the safe side, check the company’s ratings by A.M. Best, Fitch, or similar agencies. While each uses its own scale, an “A” rating or higher signals financial strength.

- Read customer reviews: Visit the Better Business Bureau and review platforms like Trustpilot or Yelp to see what other drivers say about the insurers you’re considering. Pay close attention to feedback on claim handling, coverage options, discounts, and overall customer service.

- Don’t get more than you need: Most insurers offer various coverage options and add-ons, but that doesn’t mean you need them. For example, getting collision coverage for an older car is rarely a wise choice, as the cost may exceed the payout you’d receive in the event of a claim.

- Ask how rates may change: If you’re in or approaching your 70s, ask insurance providers how rates might change over time. Some companies are more aggressive with age-based adjustments, which could lead to significantly higher premiums in the future.

3. Bundle Policies

All major insurers offer multi-policy discounts ranging from 5% to 25% or more, saving you hundreds of dollars per year. Plus, bundling policies simplifies billing and claims management, which adds to the convenience factor.

For instance, drivers insured with Amica can lower their premiums by up to 30% by bundling home, life, auto, and umbrella policies. If you purchase both home and auto insurance from Nationwide, you could save up to 15%. Similarly, Progressive’s home and auto bundle can reduce your insurance costs by up to 20% or more.

4. Take a California Mature Driver Course

Consider taking a California mature driver course to save 5-15% on auto insurance for three consecutive years. In California, the discount is mandated by law for drivers aged 55+ who complete a state-approved program.

If you haven’t taken the course before, you must commit to six and a half hours of study. To maintain the discount, you’ll need a four-hour refresher every three years. In either case, an online mature driver course offers greater flexibility and convenience than in-person lessons.

Our online program is approved by the DMV and accepted by all insurers, including GEICO, Allstate, Mercury, Farmers, and others. Go through all lessons at your own pace, pass the final exam, and submit your completion certificate to your insurance provider. It’s that simple.

Read: How the California Mature Driver Program Works

5. Drive Less

In California, drivers who log fewer miles than the national average can save around 11% on their premiums, but some insurers may lower your rates even further. If you’ve cut back on commuting and now drive less than usual, you may qualify for low-mileage discounts.

Nationwide and other insurance companies also offer pay-per-mile programs. With this option, your monthly premium will change based on how many miles you drive.

6. Choose a Safer Vehicle

Cars with advanced safety features and high crash-test ratings often cost less to insure. Most importantly, they could save your life in the event of an accident.

For instance, automatic emergency braking may reduce the risk of front-to-rear crashes by 50%. Rear automatic braking lowers the risk of backing crashes by nearly 80%, while blind spot detection can reduce the likelihood of lane-change crashes with injuries by 23%, as reported by the IIHS.

If you’re ready to ditch your old car, check out the National Highway Traffic Safety Administration’s five-star vehicle safety ratings and the IIHS’s top safety picks to better understand your options.

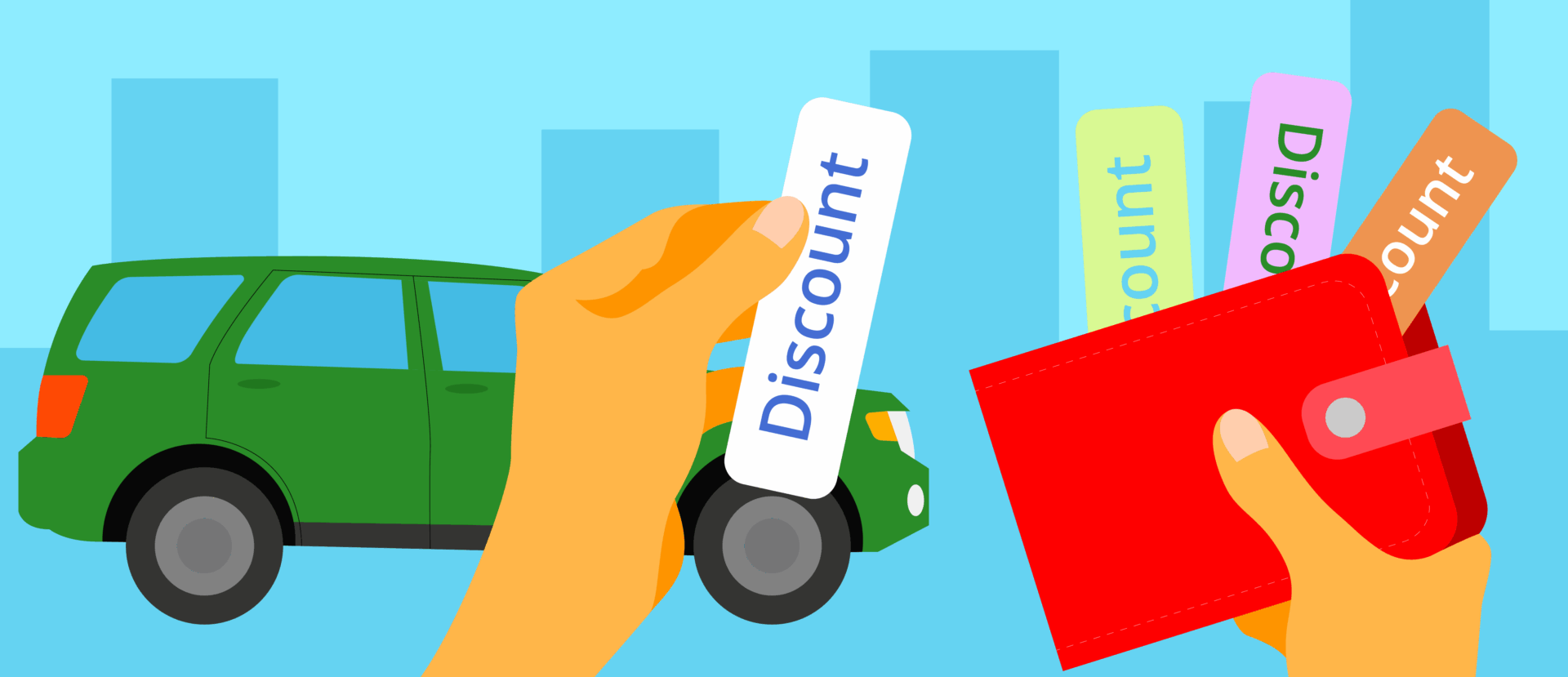

7. Ask About Other Discounts

When shopping for insurance, be sure to ask each provider—including your current insurer—about any discounts they offer. These may include:

- Safe driver discounts: 10-30%

- Multi-policy discounts: 5-25%, sometimes up to 30%

- Multi-car discounts: 10-25%

- Usage-based discounts: 5-30%

- New vehicle discounts: 5-15%

- Pay-in-full discounts: 5-10%

- Veteran discounts: 5-15%

- Defensive driving discounts: 5-15%

- No-claims discounts: 10-20%

Note that you can stack multiple discounts, up to the limit set by each insurance provider. For example, you might qualify for a mature driver discount along with a multi-policy or low-mileage discount.

8. Repeat Annually

Insurance premiums change annually, so it’s wise to review your coverage and shop around for a better deal before your policy expires. While some insurers offer loyalty discounts, switching providers could still result in lower rates.

If you sign up with a different carrier, make sure there are no lapses in coverage. Simply put, your new policy should kick in the same day your old one expires. California drivers who maintain continuous coverage may receive a “persistency” discount from insurers, which can lead to further savings.

Save on Car Insurance with Traffic Safety Institute

At Traffic Safety Institute, we offer a DMV-approved California mature driver course that can save you up to 15% on car insurance. It’s online, self-paced, and user-friendly, giving you the flexibility to study from home or on the go.

We also strive to provide a seamless learning experience through resources and perks like:

✅ Unlimited retakes

✅ Free audio read-along

✅ Clear, engaging materials

✅ Practice tests after each lesson

✅ Open-book final exam

✅ Multi-device compatibility

✅ Instant digital certificate of completion

✅ Physical certificate shipped for free

✅ 24/7 live chat support

Our self-paced course also comes with a $100 savings guarantee—though you’ll likely save even more, depending on your insurance provider. The best part is, we charge a flat fee of only [camd_price, and you don’t have to pay until you complete the program.

Become a safer driver while reducing your insurance premiums. Start our course for FREE today.

FAQs About Car Insurance for California Seniors

Looking for more information on how to find cheap car insurance for seniors? Below are the answers to some questions you may have:

Do seniors get discounts on car insurance in California?

Yes, they do. An example is the mature driver discount, which can lower your premiums by 5-15%. To qualify, policyholders must be at least 55 years old, have a clean driving record, and take a mature driver discount course.

Seniors may also apply for veteran discounts, good driver discounts, multi-policy discounts, and more. Ask your insurance provider about these options, as they may not be openly advertised.

At what age does insurance stop being expensive?

Generally, car insurance rates begin to drop around age 25, but they tend to rise again once drivers reach their early 70s. However, a 30- or 40-year-old with a poor driving record may pay higher premiums than a 75-year-old who has maintained a clean record.

Why is auto insurance so high for seniors?

Seniors pay higher premiums than younger drivers because they’re statistically more likely to be involved in a fatal crash. Plus, they face an increased risk of serious injury if an accident occurs.

What company has the cheapest car insurance for seniors?

According to NerdWallet and other insurance comparison platforms, GEICO consistently offers some of the best rates for older drivers. Another solid option is USAA, though in states like California, its auto insurance policies are available only to military members, veterans, and their families.

Note that premiums vary by ZIP code and individual factors. An insurance carrier might have affordable coverage for seniors in one city or county while charging above-average rates in another.

At what age does car insurance increase for seniors?

Depending on the insurance provider, seniors often begin to see higher premiums after age 70. However, it’s still possible to cut costs by applying for insurance discounts, such as those offered for completing defensive driving courses or bundling multiple policies.